vermont income tax withholding

5 rows The income tax withholding for the State of Vermont includes the following changes. Single or Head of Household.

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

No action on the part of the employee or the personnel office is necessary.

. Estimated tax payments must be sent to the Vermont Department of Taxes on a quarterly basis. If Federal exemptions were used and there are additional withholdings proceed to step 8. Tax Rates and Charts Tue 12212021 - 1200.

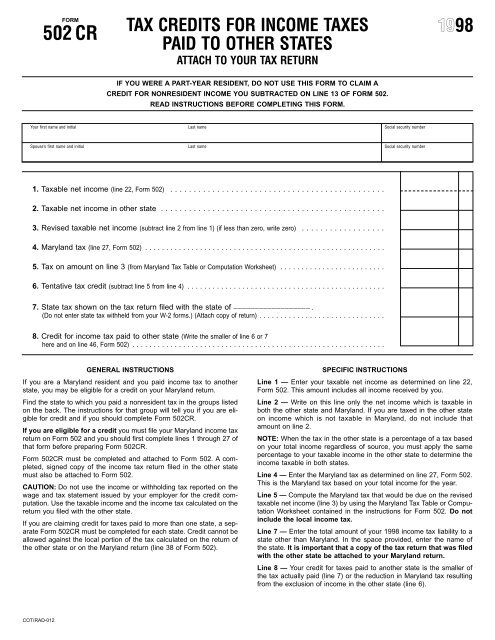

PA-1 Special Power of Attorney. If additional Federal tax was withheld multiply the additional amount by 26 percent and add that to the result of step 7 to obtain the biweekly Vermont tax withholding. A reproduction of the 2019 annual percentage method withholding tables begins on page 2.

The Amount of Vermont Tax Withholding Should Be. The gov means its official. The Single or Head of Household and Married income tax withholding tables have changed.

If Federal exemptions were used and there are additional Federal withholdings proceed to step 8. The income tax withholding formula for the State of Vermont will include the following changes. Tuesday December 21 2021 - 1200.

Her W-4VT form claims two withholding allowances and married status. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. The annual amount per allowance has changed from 4350 to 4400.

No action on the part of the employee or the personnel office is necessary. The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022. The Single or Head of Household and Married withholding tables will increase.

No action on the part of the employee or the personnel office is necessary. If you received Form 1099-G for unemployment compensation from the Vermont Department of Labor and have questions please review information on the Department of Labors website. FS-1278 - Self-Employment Income Taxation.

Apply the taxable income computed in step 5 to the following table to determine the annual Vermont tax withholding. The annual amount per exemption will increase from 4000 to 4050. Our mission is to serve Vermonters by administering our tax laws fairly and efficiently to help taxpayers.

An employee is paid 1800 each week. TAXES 16-09 Vermont State Income Tax Withholding. Plan the correct withholding rate is 6 of the deferred payment.

If Federal exemptions were used and there are additional withholdings proceed to step 8. The Amount of Tax Withholding Should Be. Reporting and Remitting Vermont Income Tax Withheld.

The Single and Married income tax withholdings will increase for the State of Vermont as a result of changes to the formula for tax year 2017. State government websites often end in gov or mil. To calculate taxable income in Vermont begin with federal taxable income which can be located on your Federal Form 1040Income Tax Brackets.

If you pay wages or make payments to Vermont income. Tax Withholding Table. Understand and comply with their state tax obligations.

If additional Federal tax was withheld multiply the additional amount by 26 percent and add that to the result of step 7 to obtain the biweekly Vermont tax withholding. Before sharing sensitive information make sure youre on a state government site. 521633 plus 760 of excess over 102375.

W-4VT Employees Withholding Allowance Certificate. Your payment schedule ultimately will depend on the average amount you withhhold from employee wages over time. The income tax withholding for the State of Vermont includes the following changes.

Divide the annual tax withholding by 27 to obtain the biweekly Vermont tax withholding. If the Amount of Taxable Income Is. Tax Formula Withholding Formula Effective Pay Period 06 2017.

The more you withhold the more frequently youll need to make withholding tax payments. The Vermont Department of Taxes released its 2019 state income tax withholding tables and guide. Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding.

March 23 2016 Effective. The annual amount per exemption has increased from 4250 to 4350. Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding.

Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding. 2022 Income Tax Withholding Instructions Tables and Charts. The income tax withholding for the State of Vermont includes the following changes.

Vermont has no cities that levy a local income tax. Span Class result type PDF span State Of Vermont 2022 Income Tax Withholding Instructions. Vermont withholding is 50938392 x 00660 554 554 4539 5093 Because 162692 falls between 1543 and 3463 the tax is computed as 4539 plus 660 of the amount over 1543.

IN-111 Vermont Income Tax Return. Vermont School District Codes. If additional Federal tax was withheld multiply the additional amount by 27 percent and add that to the result of step 7 to obtain the.

Over 102375 but not over 210125. The withholding is based on both the deferred payment and any income that may be derived from the deferred compensation. Vermont 2019 income tax withholding instructions tables and charts The supplemental rate is increased to 30 of federal income tax withholding.

If Federal exemptions were used and there are additional withholdings proceed to step 8. If the Amount of Taxable Income Is. The income tax withholding formula for the State of Vermont will include the following changes.

This means that whether you live in Burlington Rutland or anywhere in between you wont have an additional local withholding. Semiweekly monthly or quarterly. Form IN-151 - Application for.

In Vermont there are three main payment schedules for withholding taxes. Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding. If youre a single filer with 40350 or below in annual taxable income youll pay the lowest state income tax rate in Vermont at 335.

The Single Head of Household and Married annual income tax withholding tables have changed. An Official Vermont Government Website. The Amount of Vermont Tax Withholding Should Be.

2022 Income Tax Withholding Instructions Tables and Charts. Tax Rates and Charts Tuesday December 21 2021 - 1200.

Personal Income Tax Woes Plague State Revenues Again Vermont Business Magazine

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Fiscal Year To Date Figures Show Declines In Income Tax Collections Download Scientific Diagram

State W 4 Form Detailed Withholding Forms By State Chart

State Corporate Income Tax Rates And Brackets Tax Foundation

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

Paycheck Taxes Federal State Local Withholding H R Block

State Income Tax Rates Highest Lowest 2021 Changes

File Top Marginal State Income Tax Rate Svg Wikipedia

Strength In Personal Income Leads Tax Revenue Results Vermont Business Magazine

State Income Tax Withholding Considerations A Better Way To Blog Paymaster

How Is Tax Liability Calculated Common Tax Questions Answered

Tax Rates And Income Brackets For 2020

How Is Tax Liability Calculated Common Tax Questions Answered

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)